The Blog

The Human Cost of Leadership: Engaging in Mutual Understanding

By SherylX and Ms Millennial Money

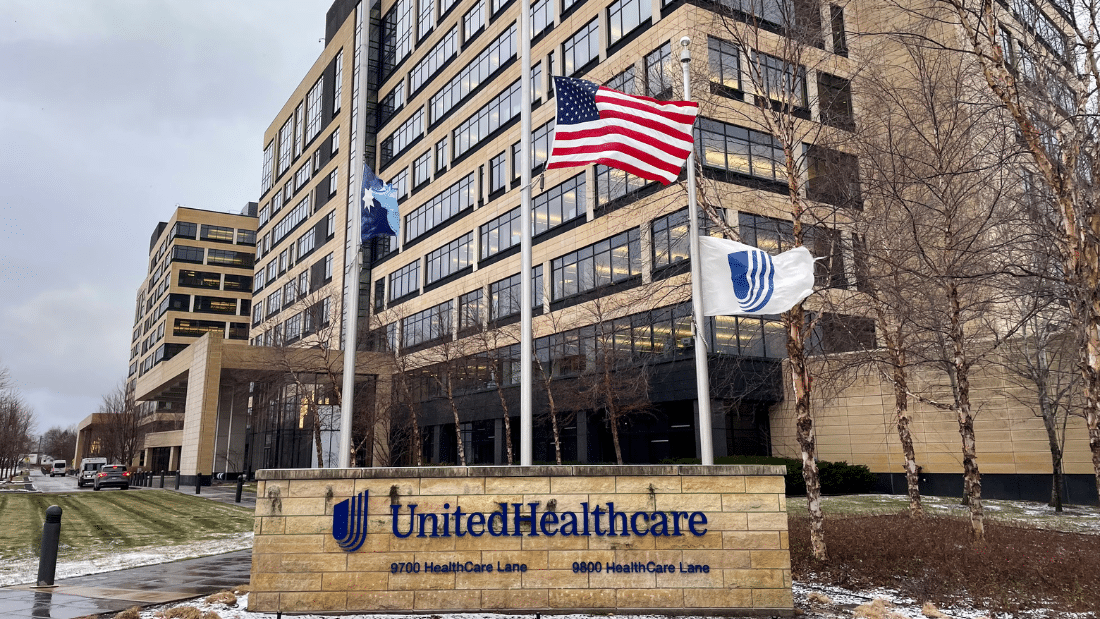

The tragic shooting of UnitedHealthcare CEO Brian Thompson in New York has sparked a wave of discussions, revealing the deeply personal and societal complexities surrounding corporate leadership. For those of us at TEA, this story sparks many contemplations, highlighting not just the immense responsibilities of corporate directors but also the risks—personal, financial, and physical—that they shoulder.

There is much to unbox, and as shareholder engagement and corporate governance buffs, we spend a lot of time scrutinising corporate boards, especially during AGM season. But how often do we pause to acknowledge the humanity of these leaders? In this first installation we will look at human impact on board directors and think about how we properly reward them.

Thompson’s devastating death reminds us that beyond the titles, metrics, and remuneration figures, CEOs are people—they are spouses, parents, and community members—dedicated to steering their companies through turbulent waters.

The Heavy Price of Leadership

Brian Thompson was a devoted father of two and a transformative leader who helped UnitedHealth Group achieve $281 billion in profits in 2023. Despite these achievements, his role placed him under extraordinary scrutiny and, ultimately, in the line of fire. His suspected assailant, Luigi Mangione, reportedly acted out of frustration over perceived healthcare inequities—an unsettling example of societal anger taking an extreme and violent turn.

Shockingly, the response to this tragedy was not universally one of mourning. While there have been many intelligent people opining on how the state of the US healthcare system led to the killing of Thompson, including Gen Z Brit, Fads, social media platforms saw an alarming celebration of the attack, with younger generations in particular expressing support. Merchandising platforms like Etsy and Amazon even had to ban items celebrating the shooter, reflecting a growing divide between business leaders and public sentiment.

This chilling event underscores a pivotal question: if CEOs are expected to deliver not only financial performance but also endure mounting public hostility and personal risk, are they being adequately recognised and rewarded for the challenges they face?

A Crossroads for Executive Pay

In the UK, executive pay has long been a contentious issue. The media thrives on stories of ‘overpaid’ executives, but compared to markets like the US, UK CEO packages are modest.

In 2023, the average FTSE 100 CEO earned about £3.8 million ($4.75 million), while their S&P 500 counterparts made an average of $16.7 million. Digging deeper within the same sectors reveals even more stark discrepancies—ExxonMobil CEO Darren Wood earned $37 million last year, which is nearly four times what Shell’s Wael Sawan made, at $10 million.

This pay gap is not just a numbers game; it’s driving talent out of the country. Why, when facing personal and safety pressures, as well as work pressures, would top leaders choose a market that undervalues their contributions when they can earn exponentially more elsewhere? AstraZeneca, for example, raised concerns about its CEO’s pay, only to face fierce backlash from shareholders. Similarly, Unilever and Pearson have experienced pushback on proposed pay increases, despite these adjustments being critical to retaining world-class talent.

London Stock Exchange CEO, Julia Hoggett, has waded in on the issue as well, having watched as promising British firms have delisted to move to the US or Europe. She believes that offering more attractive pay packages is essential to curb this trend, stating, ‘We’ve hamstrung ourselves from creating a level playing field with which to compete with the rest of the world… We need to understand the potential impact that executive pay has on our ability to create globally influential companies.’

The Balance of Sticks and Carrots

Institutional investors and proxy advisory firms like ISS and Glass Lewis often champion tighter pay structures, but this rigidity risks stifling the UK’s competitiveness. Meanwhile, retail investors seem more aligned with the reality that competitive compensation is vital for long-term success. For instance, Tesla’s largely retail shareholder base overwhelmingly supported Elon Musk’s $56 billion compensation package, recognising the value he brings to the company.

If the UK is to compete on a global stage and ask our leaders to potentially put themselves in harm’s way, we must have better engagement between companies, investors and individuals, rethinking our approach to executive pay. Offering fair and competitive remuneration isn’t just about rewarding performance; it’s about attracting and retaining leaders capable of navigating complex global markets.

Creating a Culture of Support and Success

The conversation about executive pay needs a new narrative—one that shifts from criticism to collaboration. Shareholders, media, and the public could focus on understanding the challenges faced by leaders and the concerns the wider public have about corporate governance, supporting engagement and mutual understanding rather judging people on their pay packages. This collaborative approach could foster an environment where CEOs feel empowered to drive innovation and growth while navigating the increasingly complex societal expectations placed upon them.

As Brian Thompson’s tragic story illustrates, the stakes for CEOs today extend far beyond boardrooms and balance sheets. If we want to cultivate a thriving corporate ecosystem, where public concerns are addressed and considered, and where we strive towards solutions for all stakeholders, we must embrace a more nuanced understanding of leadership—and compensate it accordingly.

Let’s rally around our leaders, not tear them down, and ensure that the UK remains a competitive, dynamic, and innovative force in the global economy.

What Do You Think?

Should the UK rethink its approach to CEO remuneration? How can we strike the right balance between accountability and fairness? We’d love to hear your thoughts—let’s keep the conversation going.

Join TEA! Let's shape the financial inclusion agenda together by facilitating inclusive investor engagement. Sign up now for FREE!

Join us

Sign up to our newsletter to stay up to date