The Blog

Shein’s Potential Listing on the London Stock Exchange: Implications for UK Shareholders

By Joseph Vambe

Introduction

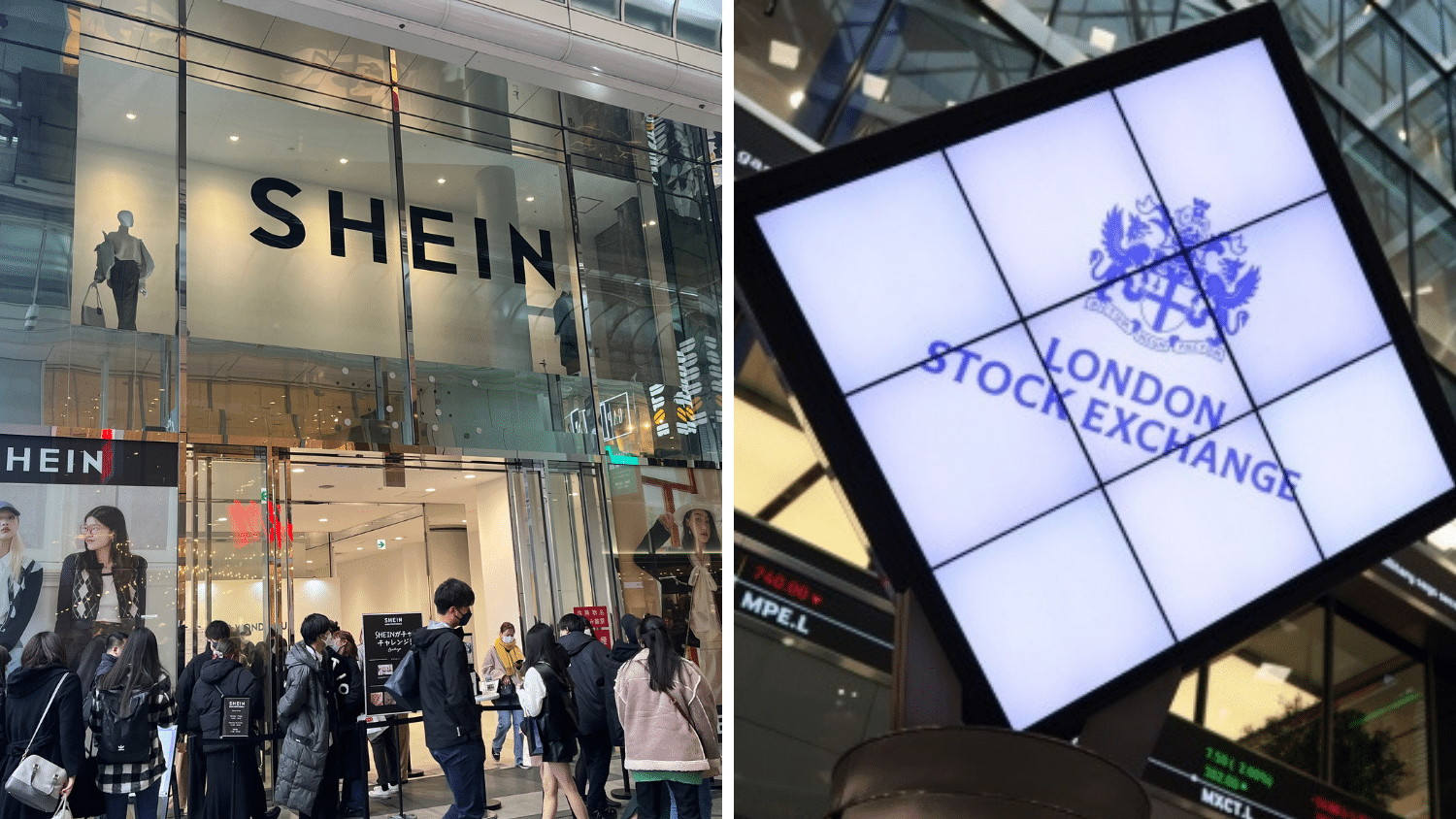

Shein, the ultra-fast-fashion retailer known for its trendy and affordable clothing, is considering a significant shift in its initial public offering (IPO) plans. Initially eyeing the New York Stock Exchange (NYSE), Shein has faced regulatory hurdles and political scrutiny in the United States, prompting the company to explore the London Stock Exchange (LSE) as an alternative. For UK shareholders, this potential listing raises several questions about the company, its controversies, and what a London IPO might mean for investors.

What is Shein?

Shein is an online fashion retailer that has gained immense popularity, particularly among Gen Z consumers, for its vast array of affordable and fashionable clothing. Founded in China and now domiciled in Singapore, Shein operates predominantly online, offering a rapid turnaround of fashion trends at low prices. The company’s business model relies on an extensive network of third-party manufacturers, primarily based in China, allowing it to maintain low production costs and high inventory turnover.

Valued at approximately $66 billion, Shein has become a formidable player in the global fashion industry. Despite its success, the company has not been without controversy, facing criticism over labour practices, environmental impact, and intellectual property issues.

Prevailing Issues Surrounding Shein’s Listing

The decision on where to list Shein’s IPO has been fraught with complications, largely due to geopolitical tensions and regulatory concerns. Initially, Shein aimed for a New York listing, but this plan hit several roadblocks. Relations between the US and China have been strained, impacting Chinese companies’ ability to list on American exchanges. US lawmakers have raised concerns about Shein’s ties to China, questioning the transparency of its operations and its data privacy practices.

Shein’s supply chain practices have come under intense scrutiny. Allegations of forced labour in the Xinjiang region and questions about the company’s use of tariffs to bypass trade regulations have made US regulators wary. The US Securities and Exchange Commission (SEC) has yet to advance Shein’s IPO filing, and the Chinese Securities Regulatory Commission (CSRC) has also been cautious in granting approval.

Shein’s business practices, particularly regarding labour conditions and environmental sustainability, have been criticised. Reports of employees working excessively long hours and the company’s significant environmental footprint have raised red flags among investors focused on environmental, social, and governance (ESG) criteria.

Why Shein is Considering the London Stock Exchange

Given these hurdles, Shein is now looking at the LSE as a viable alternative. The UK may offer a more favourable regulatory environment compared to the US. While the UK has stringent regulations, the political climate may be less adversarial towards Shein, especially if the company can demonstrate improvements in its governance and operational transparency.

Listing on the LSE could provide Shein with access to a different pool of investors and potentially less regulatory friction. The LSE has been actively seeking high-profile listings to bolster its status and compete with larger exchanges like NYSE and Nasdaq.

A London listing could help Shein enhance its global image, positioning itself as an international rather than a purely Chinese company. This strategic move could help mitigate some of the geopolitical risks associated with its operations.

London’s financial market, though smaller than New York’s, still offers substantial liquidity and a diverse investor base. This could attract a broad range of institutional and retail investors, providing Shein with a solid platform for growth.

How Shein Might Need to Reform

For Shein to successfully list on the LSE and appeal to UK investors, several reforms might be necessary. Shein will need to demonstrate robust corporate governance practices. This includes greater transparency in its supply chain, clear policies on labour practices, and a commitment to ethical standards. Enhancing governance structures can help build investor confidence and align with the expectations of UK regulators and shareholders.

Addressing ESG concerns will be crucial. Shein must take tangible steps to improve working conditions within its supply chain, reduce its environmental impact, and ensure ethical sourcing of materials. Regular audits and public reporting on these initiatives can help reassure investors about the company’s commitment to sustainability.

Ensuring full compliance with UK and international trade regulations will be essential. This includes adhering to tariff rules, data privacy laws, and other regulatory requirements. Demonstrating a proactive approach to compliance can mitigate risks and build trust with regulators and investors.

Active engagement with stakeholders, including investors, employees, and advocacy groups, can help Shein address concerns and build a positive reputation. Transparent communication about the company’s efforts to reform and improve can foster goodwill and support from the broader community.

Potential Reactions of UK Investors

UK investors might have mixed reactions to Shein’s potential listing on the LSE. Many investors will be attracted to Shein’s impressive growth trajectory and market potential. As one of the largest players in the fast-fashion industry, Shein offers significant opportunities for returns, which could be appealing to both institutional and retail investors.

Investors with a strong focus on ESG criteria may approach Shein’s listing with caution. The company’s past controversies regarding labour practices and environmental impact could deter socially conscious investors. However, demonstrated reforms and commitments to improvement could alleviate some concerns.

Some investors may be wary of the geopolitical risks associated with Shein’s operations. The company’s ties to China and the potential for future regulatory challenges could introduce volatility and uncertainty, impacting investment decisions.

The valuation of Shein at around $66 billion makes it a significant player in the market. Its listing could have substantial implications for the LSE, potentially boosting its profile and attracting further listings. However, investors will closely scrutinise the details of the IPO, including the free float and regulatory hurdles.

Shein’s inclusion in major indices, such as the FTSE 100, could lead to increased demand from index funds and ETFs. This inclusion can provide additional liquidity and stability to the stock, making it an attractive option for a broader range of investors.

Conclusion

Shein’s potential listing on the London Stock Exchange presents a unique opportunity for UK shareholders. The company’s growth potential and market presence make it an attractive investment, but the associated ethical, regulatory, and geopolitical concerns cannot be ignored. For Shein to successfully navigate this transition, it must undertake significant reforms to improve transparency, governance, and sustainability.

UK investors will need to weigh the potential rewards against the risks, considering both the company’s efforts to reform and the broader market implications. If Shein can address its controversies and present a compelling case for its listing, it could indeed become a valuable addition to the LSE, offering new opportunities for growth and diversification in the UK market. As with any investment, due diligence and a careful assessment of all factors will be essential for making informed decisions.

Broader Implications for the London Stock Exchange

The potential listing of Shein on the LSE has broader implications for the exchange itself. London has been striving to regain its stature as a premier destination for IPOs, having lost several high-profile listings to its US counterparts. Shein’s IPO could be a significant win for the LSE, helping to revitalise its reputation and attract other major international companies.

The presence of a high-growth, tech-driven company like Shein could diversify the LSE’s offerings, which have traditionally been dominated by banks, mining companies, and other established sectors. This diversification could make the LSE more attractive to a new generation of investors looking for dynamic and innovative companies.

Retail shareholders in the UK will play a crucial role in the success of Shein’s IPO. These individual investors, who often bring a long-term perspective and a personal interest in the companies they invest in, could provide stable support for Shein’s stock. Engaging with retail shareholders through transparent communication and regular updates on the company’s progress will be essential.

Shein’s ability to win over retail shareholders will depend on its commitment to addressing the ethical and sustainability issues that have plagued its reputation. Demonstrating a genuine commitment to improving labour practices and reducing environmental impact will be key to building trust with these investors.